11:00 ▪ ▪

4

min at reading ▪

US President Donald Trump is pushing Congress to immediately accept the genius by law Stablecoins. The race against the lessons begins to make the United States by the world leader in digital assets. But does this precipitation hide personal interests?

In short

- Trump urges the House of Representatives to vote “very quickly” on the Act on the Brilliant Act after receiving the Senate.

- The bill laid down the first federal regulatory framework for the Stablecoins indexed to the dollar.

- Critics condemn the conflicts of potential interests with Trump’s crypto activities.

Trump impatient face -to -face

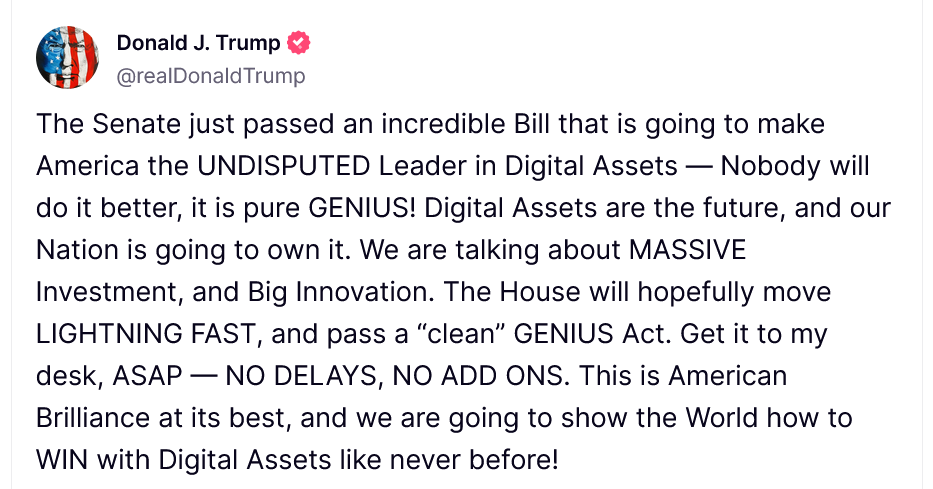

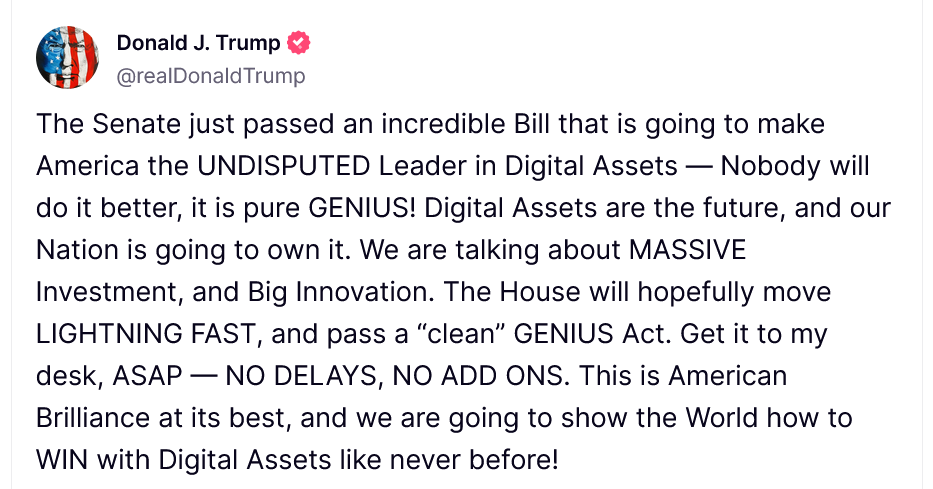

Donald Trump doesn’t celebrate his words. On Tuesday, just after the Senate voted for a brilliant law, the President published a direct message on social truth.

” The Senate has just adopted an exceptional bill of law, thanks to which America will be an indisputable leader in digital assets “, He wrote. Now he asks the House of Representatives to act at” lightning speed “.

This emergency situation is not trivial. The Senate voted massively: 68 votes for 30 against. It is a clear victory for stablecoins supporters.

Now the ball is in the camp of the House of Representatives. Republicans have a small majority, sufficient to hand over the text.

Why so much pressure? Trump wants to build America as a world leader in cryptocurrencies.

Senator Bill Hagert, who supports this project, simply explains:

This law allows companies and Americans to settle their payments almost immediately than to wait for days or even weeks.

In a world where speed counts, it is the main asset.

The stain goes far behind the United States. Other countries create their own rules for cryptocurrencies. America wants to first store its standards. The Senate’s vote shows that this ambition is formed.

Personal interests that challenge presidential neutrality

But Trump’s eagerness raises questions. Senator Elizabeth Warren openly blames him of the conflict of interest. He claims that the president and his family could earn “hundreds of millions” in dollars with their own stablecoin if this law passes.

These accusations have solid bases. In 2024, Trump gathered $ 57 million through World Liberty Financial. It also has almost 16 billion WLFI tokens. Some of this money comes from the sale of chips associated with its image as the president. The coincidence between his personal profits and the support of this law raises questions.

The legislative process will impress itself. Initially, it was a change to ban federal elected officials and use their families to use stablecoins.

This amendment has never been elected. The Democrats are calling for a “organized maneuver”. Senator Merley has not changed his words: “ These laws legitimize what looks like a massive fraud shrouded in the American flag ».

Legislation with the main geopolitical questions

Despite controversies, the brilliant law means a decisive step. It requires 100 %reserve, compulsory licenses and strict controls of the use of funds. The emitters will have to reduce their investment in safe assets such as the state treasury accounts.

While the number of stablecoin holders exceeds 160 million worldwide and the volumes of transactions have defeated records, this regulation is timely.

If adopted, this legislation could convert stablecoins into real tools of monetary sovereignty. The House of Representatives holds much more than a simple account in their hands: perhaps the future of the dollar in the world in full tokenization.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Passionate Bitcoin, I like to explore meanders blockchain and cryptos and share my discoveries with the community. My dream is to live in a world where privacy and financial freedom is guaranteed for everyone, and I firmly believe that Bitcoin is a tool that can make it possible.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.